In addition to a tenant paying Real Estate Taxes, certain tenants are required to pay a Commercial Rent Tax. This tax applies to any tenant who occupies or uses a property for commercial activity in Manhattan south of 96th Street and incurs an annual rent greater than $250,000. Tenants who are exempt from paying the Commercial Rent Tax are those with short rental periods, residential subtenant, theatrical use, and not-for-profit status.

Filing:

Tenants who are paying $250,000 or more in annual base rent (defined below) are subject to the Commercial Rent Tax and must file said tax on their annual tax returns. If a tenant is paying more than $200,000 a year, they still need to file an annual tax return, even if they are not subject to the Commercial Rent Tax. The occupant must file on or before June 20th covering the prior year (June 1st to May 31st).

Tax Rate:

The Commercial Rent Tax is 6% of the base rent. After you calculate the base rent (see below), the tenant must subtract all permissible deductions. From there on, the City of New York has granted a base rent reduction of 35% that must be applied to tax rate. This rent reduction percentage decreases the taxes by 3.9% (6% * (1-.35)). Tenants paying between $250,000 and $300,000 before the 35% rent reduction are allowed a tax credit.

Calculate the Base Rent:

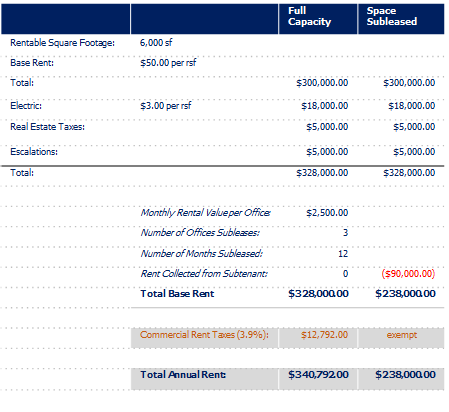

The base rent is anything you pay the landlord, which is the rent, electric (if sub-metered), rent inclusion, real estate tax, water & sprinkler charges, and escalations. The value can be offset by subletting office space to a sub-tenant. There are exclusions such as commercial revitalization programs, maintenance of space, and tenant improvements. This value is then multiplied by the 3.9% to take in account the rent reduction factor. Following is an example showing how the Commercial Rent Tax is calculated. The first example entitled “full capacity” shows a tenant leasing 5,000 rentable square feet and paying $12,792.00 in Commercial Rent Tax. In the second column entitled “space subleased” shows the same tenant subleasing 3 offices for $2,500 a month. In this scenario, the tenant does not have to pay Commercial Rent Taxes.

Companies like Pivot Desk can streamline the subleasing process and make disposing small amounts of space a quick and easy task. The following is a link to their site: www.pivotdesk.com

If you are going to sublet a couple of offices to reduce your occupancy and not pay the Commercial Rent Tax, you should consult your attorney, accountant and real estate broker to provide you with a professional opinion.